Newton’s third law of motion states that for every action, there is an equal but opposite reaction.

This holds true in markets.

The momentum that you leverage on the way up will crush you on the way back down.

The stocks that experience a meteoric rise are often the ones that crash violently back to reality and vice versa.

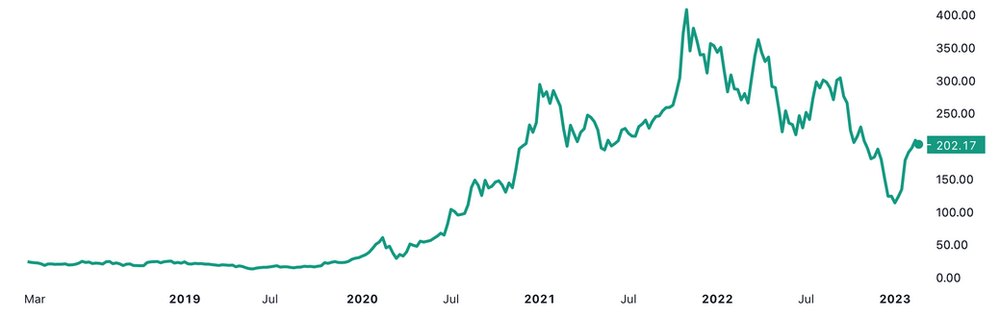

Tesla is arguably the poster child for this.

From $24 a share to $409 a share from March 2020 to November 2021 before losing 64% of its value in 2022.

So far In 2023, Tesla is up 72%.

Madness.

Tesla Stock Price

Source:Tradingview

You see this everywhere. Meta lost over a trillion dollars in market cap last year and is now up over 110% off the lows.

The list goes on.

The 50 worst-performing stocks of 2022 are up an average of 20% so far this year.

These high beta stocks will swing from overbought to oversold, and this creates opportunity. The opportunity for both wealth and destruction.

Short covering, zero-day options and momentum trading all culminate to generate massive swings for these high beta names.

But sudden price moves doesn’t mean that any of these names are now fundamental market leaders.

These are trades, not investments. There is a difference.

Want Investment Ideas That Won’t Bore You To Death?

By all means swing for the fences but If you are purchasing these names:

-

- Know what price you are going to cut your losses

-

- Know what price you are going to take your gains

-

- Size your positions properly

This market moves too fast to be YOLOing on ‘feel’.

Just ask anyone who chanced the ‘wait and see’ approach in 2022.

What is Right for You?

More than anything else, you need to decide which game you want to play.

All trading styles can be define by the amount of time each trade is held.n

-

- Seconds: Scalping

-

- Minutes: Day trading

-

- Days: Swing Trading

-

- Months: Trend Trading

-

- Years: Investing

On Average. the more frequent the time schedule, the more time consuming it will be.

Whichever one you choose is up to you, but don’t be surprised when somebody playing a different game than you ends up with different results.

Plenty of opportunity out there for each approach, but the volatility will wipe you out if you don’t adhere to rules of the game you’re playing.