A new year, a new market rally.

The fabled goldilocks scenario of falling inflation and slowing interest rate hikes was enough to warm the stock market up in January.

December saw the smallest increase in inflation in over a year. Meanwhile, the Fed reduced the size of its interest rate hikes, with the most recent 25bp hike indicating a clear policy adjustment.

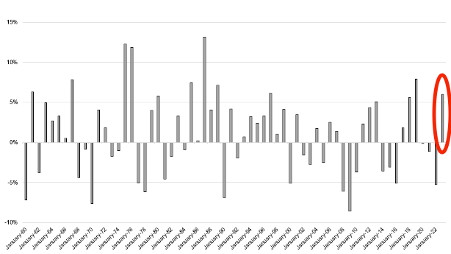

Throw in a Chinese reopening boom and a resilient labour market, and you have all the ingredients for the biggest January gain in the S&P 500 in eight years

January Performance of the S&P 500 1980-2023

Source: Ycharts

In true market fashion, last year’s losers have turned into this year’s darlings. The Tech-heavy Nasdaq Index jumped almost 11%. (now up over 17% at the time of writing).

January Performance Overview

-

- Gold saw its third consecutive monthly gain in January

-

- The dollar had its fourth consecutive monthly loss

-

- Crypto continued to rebound following the FTX fraud

Investment Ideas Straight to Your Email

Market Drivers

The stock market is a complex machine made up of thousands of moving parts but currently three major factors are determining the majority of the outcomes.

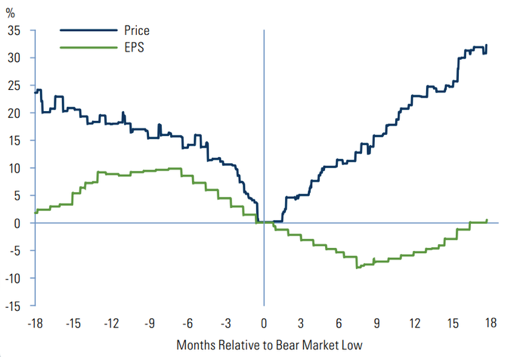

1. Earnings vs Price

As a forward-looking machine, much of the heavy lifting was done in 2022.

Despite increased company earnings, stock prices fell roughly 20% last year in anticipation of an economic slowdown.

This happens again and again.

On average, stock prices bottom roughly 6 to 9 months before company earnings bottom.

Earnings Vs Price

Source: Zerohedge

Just a reminder. The stock market is not the economy and despite the negative outlook, much of this news had already been priced in.

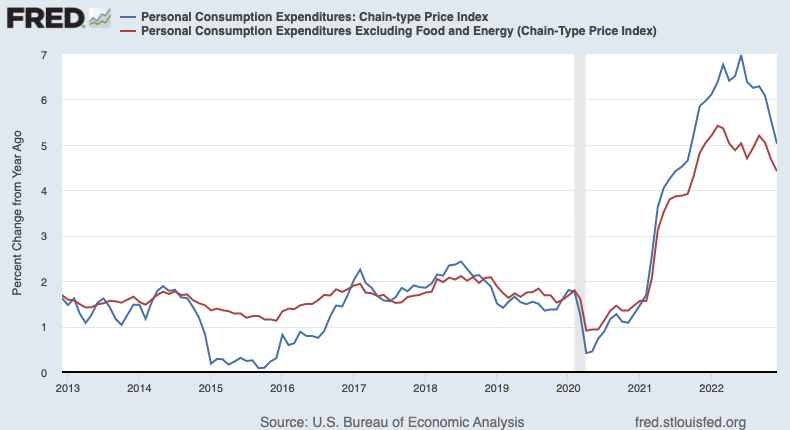

2. Inflation

According to Friday’s release, the PCE price index in December was up 5.0% from a year ago, down from 5.5% in November. Excluding food and energy prices, the core PCE price index — the Fed’s preferred measure of inflation — was up 4.4%, down from 4.7% the month prior.

Inflation Continues to Drop but Remains Elevated

Hooray!! Inflation is dead.

Not quite… but more on that later.

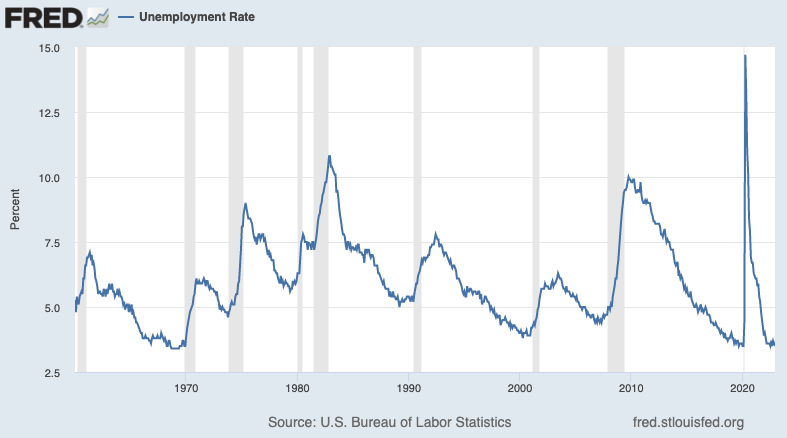

3. Resilient labour market

Despite the Fed-sponsored economic disruption, the labour market has shown resilience.

According to the Bureau of Labour Statistics, the U.S. economy added an impressive 517,000 jobs in January – the largest monthly gain since last July.

The unemployment rate is now 3.4%, the lowest level since early 1969.

Unemployment Continues to Fall

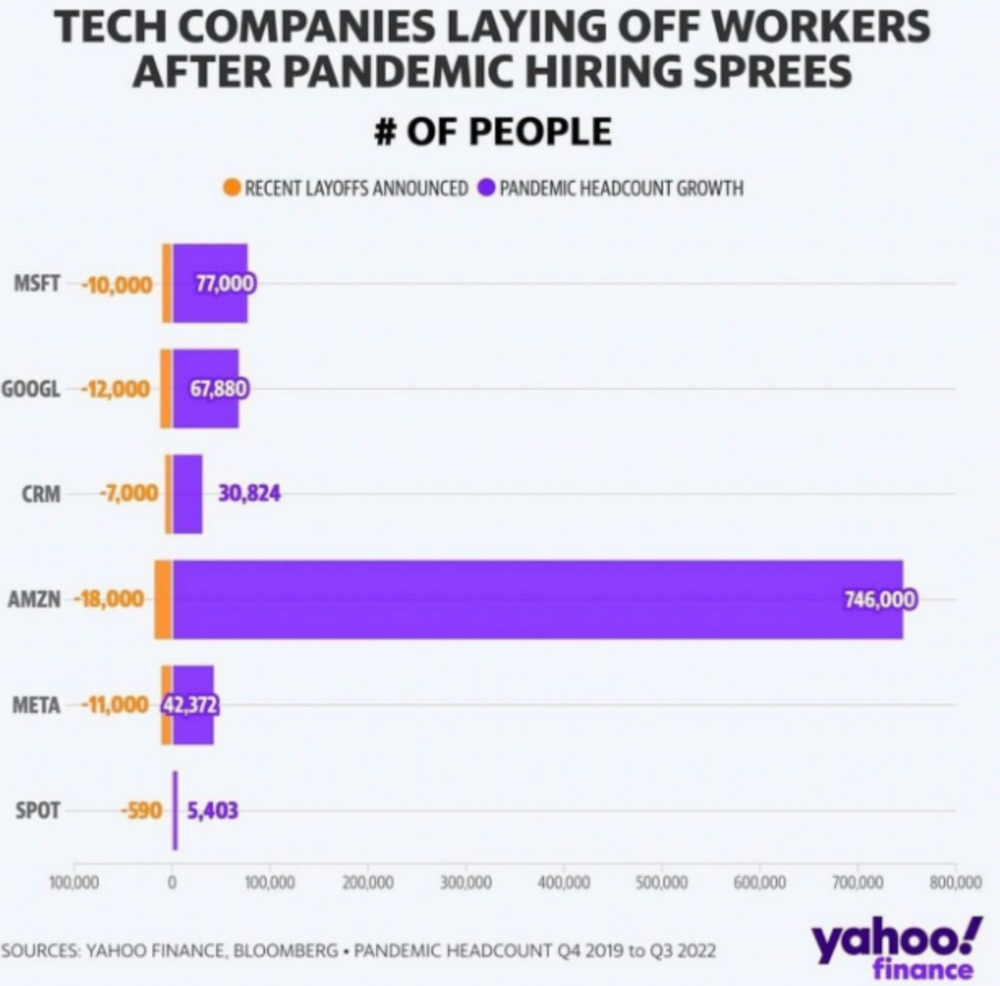

Tech lay-offs have been front and centre, but as always, there is far more to a story than the headline the media are pushing.

Yes, 1.5 million people lost their Jobs in the U.S. during December.

The crucial data point the media left out?

U.S. employers hired 6.2 million people over the same time period.

In fact, despite the media focus, the ratio of lay-offs to hires are well above historical standards.

Three points to note.

-

- Despite the struggles in the tech industry at the moment, it only represents a tiny proportion of the overall labour market. Job losses in Tech have been more than offset by new job openings across airlines, hospitality and retail.

- Even during periods of robust economic growth, employers subtracted hundreds of thousands — and sometimes millions — of jobs per month.

- Data needs context. Yes, current tech cut-backs are concerning but there is more to the story than just one data point. During the pandemic these companies pulled forward three years’ worth of demand into one. The pace was never going to be sustainable.

,,From its fiscal year-end in September 2019 to September 2022, the employee count at Amazon doubled, Microsoft’s rose 53%, Google parent Alphabet Inc.’s increased 57% and Facebook owner Meta’s ballooned 94%.

,,-Wall Street Journal

A single data point never provides the full picture.

But why let the truth get in the way of a good story eh?

The truth is, for now, hiring remains strong, and the volume of current job openings out there suggests hiring could remain strong in the months ahead.

Some leading indicators such as wage growth, temp roles and quit rates continue to fall, pointing towards the potential rise in unemployment numbers to come.

But we are not there yet.

In my opinion, we have reached ‘peak’ employment conditions. As the lag effects of tighter economic policy take hold, this labour market strength will start to show more signs of weakness.

Whether or not this can be the controlled pullback the Fed hopes for remains to be seen.

Sign up for all my latest market tips and investment advice

WHAT’S NEXT

The January market rally was a nod towards a slowdown in rate hikes and an easing in financial conditions.

The Nasdaq index is now up 17.5% in 2023.

Clearly, a soft landing is the default position on Wall Street.

I disagree with this take.

It’s easy to construct a narrative in your favour. You take the recent drop in inflation and the slowing interest rate hikes and declare victory.

Realistically, these easy narratives are worthless. The trend in the data is far more important.

Instead of rejoicing over a slowdown in inflation, you need to look at the data and ask yourself, why is inflation falling?

Is this an innocent return to trend, or is there something more sinister afoot?

For me, recessionary forces are too strong to assume inflation, and the economy will just neatly slow to a new equilibrium.

There appears to be this assumption that everything will happen in an orderly, linear fashion.

It won’t.

This isn’t the all clear.

A diversified portfolio of cashflow-centric staples and financials, energy names and short-term treasuries will offer the best risk-adjusted returns over the short term.